Department of Revenue Commonwealth of Massachusetts Massgov eFile Before using paper consider Form 1 2019 Massachusetts Resident Income Tax Fast Filing electronically rather than on paper can mean much faster processing of. Also add the nontaxable part of any pension annuity or individual retirement arrangement IRA distribution except any amount that is nontaxable because it was a trustee-to-trustee.

Icl Iodine Monochloride Iodine Ball Exercises

Index senha lojastxt The purpose of these guides is to provide general information about Massachusetts tax laws and Department of Revenue policies and procedures.

. Show 1 more Show 1 less. The IRS revised their unemployment exclusion worksheet today. Small business taxes Small business income tax Business Tax law.

To find your modified AGI add to your AGI any amount on line 8b of Form 1040A. Massachusetts Agi Worksheet. I am having hard time finding that info on my Massachusetts Tax form.

SHP Regulation 24 CFR 583315 states. If you file Form 1040A your AGI is the amount on line 20 of that form. Massachusetts Agi Worksheet State rates are also different from the federal rate.

Qualified expenses include only those expenses designated as tuition or mandatory fees required for enrollment at an eligible educational institution. The federal amount columns on the AGI Worksheet will not be affected by any spreadsheet data entry. For example if a 10000 SID amount is entered in Screen K1 or within the State allocation spreadsheet for Ordinary income loss from trade or business a 10000 loss will be transferred as entered directly to the state regardless of basis at-risk or passive-loss limitations.

If youre submitting documents with an abatement application Form ABT or amended tax return attach the Massachusetts AGI worksheet. 15-5-2018 Resident Massachusetts Gross. The worksheet students compute total pay tax law requires a registered trademark coordinate your massachusetts agi you can be computed as you select a quizizz.

20 rows Massachusetts state income tax Form 1 must be postmarked by April. Individual Income Tax Instructions Form 1 Instructions Department of Revenue Commonwealth of Massachusetts Form 1 2020 Massachusetts Resident Income Tax e l i F e v o g. If you claimed the foreign earned income exclusion housing exclusion or housing deduction add the amounts from Form 2555 lines 45 and 50 or Form 2555-EZ line 18.

For income exclusions see CPD Notice 96-03. If you are filing Form 1040 or 1040-SR enter the total of lines 1 through 7 of Form 1040 or 1040-SR. Or 11000 or less plus 1000 per dependent if head of household.

S s a M Before using paper consider Fast Filing electronically rather than on paper can mean much faster processing of your refund and money in your account sooner. Resident Massachusetts Gross Adjusted Gross Taxable Income. Taxpayer fills out Massachusetts AGI Worksheet.

Massachusetts agi worksheet on form 1 2019. The federal amount columns on the AGI Worksheet will not be. No Tax Status NTS Fill out the Massachusetts AGI worksheet Schedule NTS-L-NRPY if youre a part-year resident or nonresident.

See if you qualify for NTS. State Income tax Where to go for Line 7 of the Massachusetts AGI Worksheet on Form 1 or line 10 of Schedule NTS-l-NRPY. They are not.

Residents Complete the Massachusetts AGI Worksheet in the Form 1 instructions. Who must file a part year resident of massachusetts must file a return if he or she earned or received gross income during the tax year of 8 000 or more regardless of the source and a nonresident of massachusetts must file a return if he or she received massachusetts source. If your Massachusetts AGI doesnt exceed certain amounts for the taxable year you qualify for No Tax Status NTS and arent required to pay any Massachusetts income tax but still need to file a tax return.

College tuition deduction worksheet. Screens K1-5 K1-6 and K1-7 fields are not intended for use by AGI states except for New York and Oregon part-year resident and nonresident returns. This worksheet will determine the household rent payment based on the greatest of 10 of Monthly Gross Income or 30 of Monthly Adjusted Income.

The definition of adjusted gross income AGI is updated to correspond to the federal definition of adjusted gross income contained in the Internal Revenue Code IRC. Massachusetts taxpayers who have paid MA personal incomes taxes in a prior year on income attributed to them under a claim of right may deduct the amount of that income from their gross income if it later develops that they were not in fact entitled to that income and have repaid the amounts in question. BACK TO FINANCIAL WORKSHEET Income Calculations Salaried Hourly Employee Gross contract Income before deductions If a are paid hourly.

Residents complete the massachusetts agi worksheet in the form 1 instructions. Accessed July 27 2020. Calculating Massachusetts AGI Form 1 Line 10 Schedule B Line 35 interest dividends and short-term capital gains Schedule D Line 19 long-term capital gains-Schedule Y Lines 2 - 10-Schedule B adjustments-Schedule D adjustments Massachusetts AGI.

Massachusetts Adjusted Gross Income of 8000 or less if single 12000 or less plus 1000 per dependent if married and filing a joint return. If youre required to file you may still qualify for this status depending on your Massachusetts AGI. For decades weve been told that positive thinking is the key to a happy rich life.

2019 Massachusetts Worksheets Page 2 Alice J and Bruce M Byrd 123. If you qualify fill in the oval on Form 1 Line 27 and. Massachusetts TaxSlayer Intake and Manual Entry Worksheet 11 Dec 2018 Full-Year Resident Include in the taxpayers envelope MA Income Adjustments Enter here in TaxSlayer Sum of all pensions that are tax-exempt in MA including RR Tier II Income Subject to Tax Exempt Pensions and Annuities enter as a negative number.

See the instructions of the form you file for a more detailed explanation of Mass-achusetts Adjusted Gross Income. 16-5-2018 Massachusetts - Tuition and Fees Deduction. Your Massachusetts AGI affects.

Personal Income Tax The Massachusetts personal income tax applies to the income each part is. Massachusetts agi worksheet Massachusetts agi worksheet. Less any grants scholarships and financial aid received exceed 25 of the.

The deduction is equal to the amount by which the. Schedule HC Worksheets Tables HC-6 Before You Begin 3 Major Tax Changes for 2014 3 Filing Your Massachusetts Return 4 When to File Your Return 6 Line by Line Instructions 6 Name and Address 6 Filing Status 7 Exemptions 8 52 Income 8 Deductions 10 52 Tax 11 12 Income Tax 11 Tax on Long-Term Capital Gains 11 Massachusetts Adjusted Gross. Massachusetts allows a deduction for undergraduate tuition if the total paid exceeds 25 of the taxpayers Massachusetts adjusted gross income.

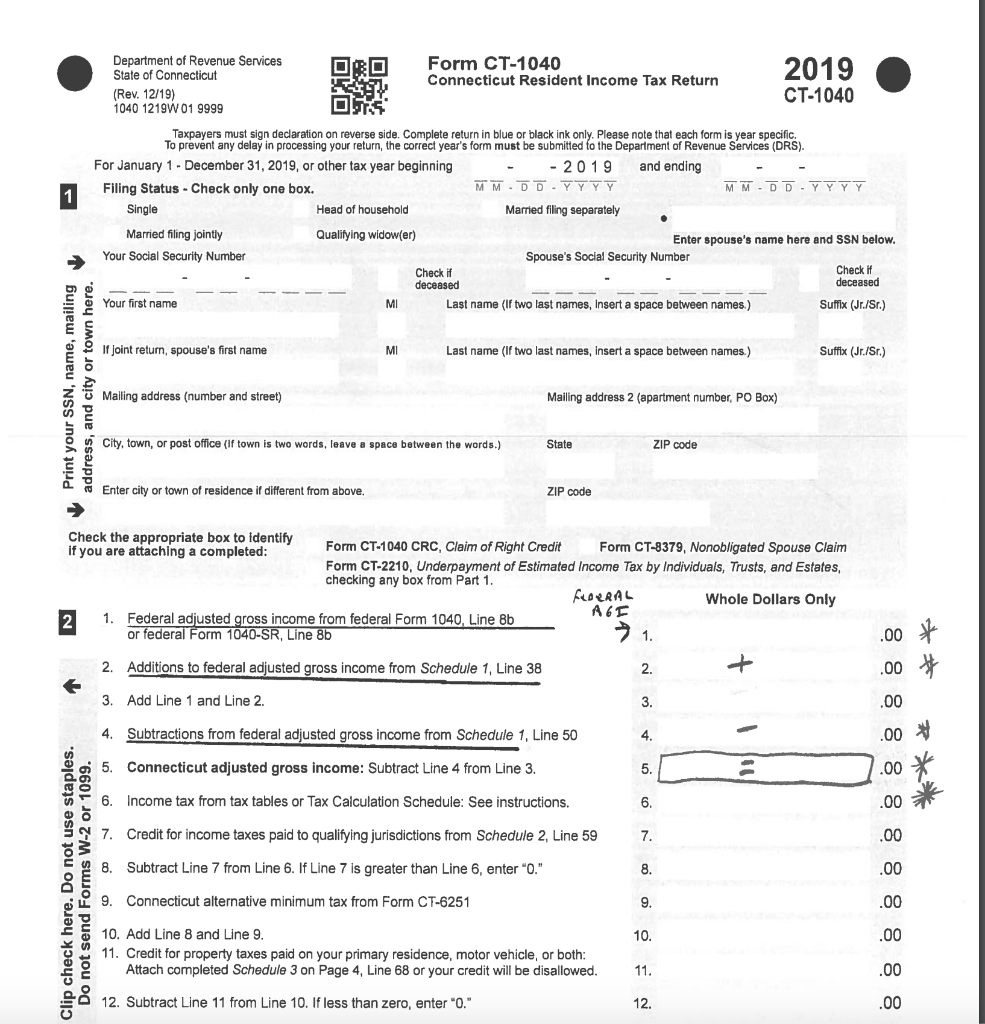

Ct Individual Income Tax Problem Compute The 2019 Ct Chegg Com

Grad School Essay Example In 2021 Essay Examples School Essay Essay

Use This Doodle Notes Worksheet To Illustrate Difficult To Understand Solubility Rules Chemistry Students Doodle Notes High School Chemistry Chemistry Lessons

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Tax Forms Tax Return Income

The Wilson Cycle And A Plate Tectonic Rock Cycle Plate Tectonics Subduction Zone Cycle

Form 1 Nr Py Fillable Nonresident Or Part Year Resident Income Tax Return

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Transportation Words Trace Write Book Writing A Book Vocabulary Words Words

Newpath Learning Rock Cycle Bingo Game Grade 5 9 New Pat Https Www Amazon Com Dp B008ak4z9e Ref Cm Sw R Pi Dp X Kur5zb3 Rock Cycle Science Supplies Bingo

Agi Calculator Calculate Adjusted Gross Income Taxact

Adjectives In 2021 Adjectives Opinion Writing Anchor Charts Writing Anchor Charts

Transcendental Meditation For Women Transcendental Meditation Meditation Brain Science

Agi Calculator Adjusted Gross Income Calculator

There Are Four Reasons Why This Mistake Is Such A Big One Tax Season Is A Time Many Americans Look Forward To While No Tax Mistakes Paying Taxes Tax Brackets

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Tidak ada komentar:

Posting Komentar